Search for answers or browse our knowledge base.

-

Basic Tenets of Faith

- How do we purify things?

- How should parents deal with a son/daughter who was a Muslim and then he/she became an atheist?

- How should the traveler pray?

- I breastfed my friend’s daughter for several weeks and she is my foster suckling daughter. She is now 17 and my son is 18. I understand they could NEVER get married as they shared the same milk. Is it permissible for my 22 year old son to marry her? Or is that Haram for them?

- If I missed a prayer, do I pray it when I remember it or do I wait till the next day time of the missed prayer?

- Is circumcision for males obligatory?

- Is it a sin to sleep through Fajir prayer?

- What are actions that require wudu’ that are agreed upon by Muslim jurists?

- What are impermissible acts during menses and post-childbirth bleeding which are agreed upon?

- What are obligatory acts of wudu’ which are agreed upon by the Muslim jurists?

- What are the conditions for the acceptance of the Shahada statement?

- What are the obligatory acts of wudu’ that are disagreed upon by the Muslim jurists?

- What did our Prophet pbuh say about the characteristics of al-Fitrah?

- What is the definition of tahara (purification) in Islam?

- What is the ruling on women performing the pilgrimage Hajj/Ummrah without a mahram?

- What is the time period for shaving pubic hair and pulling out underarm hair?

- Would I get a reward for intending to do a specific worship act, and unexpected sickness or travel prevented me from actually doing it?

- Are the acts of excelling in family relations, maintaining good ties of kinship, increasing Qur’an recitation, and increasing charity to the poor, more preferred in Ramadan?

- Can a Muslim celebrate and greet people on the Gregorian “New Year”?

- Can a person leave the masjid to take a shower at home to get rid of the sweat and to change clothes?

- Can I name my child Jibreel? and if not, what is the difference between naming after prophets and after angels?

- Can i’tikaf be done in any masjid?

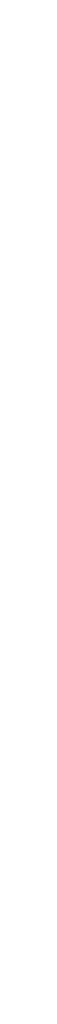

- Can we offer Qurbani on behalf of a dead person?

- Can we offer Qurbani on behalf of Prophet Muhammad SAW?

- Did the Messenger of Allah (ﷺ) urge on repeating the performance of ‘Umrah?

- Do we have to shorten and combine prayers during travel?

- Does i’tikaf only pertain to a person who is fasting?

- Does i’tikaf only pertain to Ramadan?

- How do we purify things?

- How does one perform tayammum?

- How many times can I redo Salatul Istikhara?

- If a father has family obligations, can he still perform i’tikaf?

- In what cases is it permissible to combine prayers together while not being on travel?

- Is circumcision for males obligatory?

- Is it better to wipe over the socks or to wash the feet while being at home?

- Is it obligatory to make up the i’tikaf if someone broke it during the ten nights?

- Is it permissible for the wife or children to visit their dad while he is in his i’tikaf?

- Is it permissible to bury two people in one grave?

- Is it permissible to greet Muslims on social media with the phrase " Jummah Mubarakah" on the day of Friday?

- Is it permissible to wipe over a head covering?

- Is it permissible to wipe over casts, wraps, and similar items?

- Is it required to do dry ablution in addition to wiping the injured body part and washing the healthy body parts?

- Is saying "Jumuah Mubarakah" a Bid’ah (innovation)?

- Is the growing of the beard mandatory?

- Is there an expiation for the major sin of having intercourse during menses?

- Must a person complete the full ten nights of i’tikaf to get the reward?

- What about those who have intercourse during menses?

- What are actions that invalidate an i’tikaf?

- What are actions that require wudu’ that are disagreed upon by Muslim jurists?

- What are actions which cause major ritual impurity/require ghusl that are agreed upon by Muslim jurists?

- What are actions which require ghusl (bathing) that are disagreed upon by Muslim jurists?

- What are considered impurities according to all Muslim scholars?

- What are examples of emergencies where a person in i’tikaf can leave the masjid temporarily and then return to the masjid to complete the i’tikaf?

- What are impermissible acts during menses and post-childbirth bleeding which are disagreed upon?

- What are impurities that are controversial amongst scholars, with the stronger opinion being that they are impure?

- What are nullifying acts of wudu’ that are agreed upon by Muslim jurists?

- What are nullifying acts of wudu’ that are disagreed upon by Muslim jurists?

- What are other matters related to ghusl?

- What are other notes concerning wudu’?

- What are prohibited acts for one in a state of major ritual impurity that are agreed upon by Muslim jurists?

- What are prohibited acts for one in a state of major ritual impurity that are disagreed upon by Muslim jurists?

- What are recommended acts while fasting?

- What are the actions for which wudu’ is preferred?

- What are the conditions of 'Umrah for a person who wishes to perform it?

- What are the conditions of wiping which are agreed upon?

- What are the conditions of wiping which are disagreed upon?

- What are the etiquettes when utilizing the bathroom?

- What are the nullifiers of tayammum?

- What are the obligatory actions for ghusl that are agreed upon by Muslim jurists?

- What are the obligatory actions for ghusl that are disagreed upon by Muslim jurists?

- What are the pillars and conditions of doing an i’tikaf?

- What are the pillars and conditions of doing an i’tikaf?

- What are the reasons for the permissibility of tayammum which are agreed upon by the Muslim jurists?

- What are the reasons for the permissibility of tayammum which are disagreed upon by the Muslim jurists?

- What are the recommended actions for ghusl in order to adhere to the actions of the Prophet pbuh?

- What are the specifications of the socks and shoes that are to be wiped on?

- What are the three types of major ritual impurity?

- What are the times and events for which ghusl is preferred?

- What are the two types of purification?

- What are the two types of ritual purification?

- What determines the end of blood flow?

- What did our Prophet (pbuh) say about the characteristics of al-Fitrah?

- What is considered prolonged blood flow?

- What is meant by ‘Umrah?

- What is meant by wisal (connected fasting) and what is its ruling?

- What is tayammum?

- What is the condition that Allah swt loves His slaves to be in?

- What is the definition of menstruation?

- What is the definition of post-childbirth bleeding?

- What is the definition of tahara (purification) in Islam?

- What is the duration for wiping on top of footwear?

- What is the duration of post-childbirth bleeding?

- What is the evidence as to why a menstruating woman needs to make up for her missed fasts but not for her prayers?

- What is the fate of the parents of the Messenger, may peace and blessings be upon him?

- What is the length of a menstrual cycle?

- What is the merit and reward of ‘Umrah?

- What is the merit of the sacred House of Allah?

- What is the minimum time a person can spend in seclusion for it to be considered an i’tikaf?

- What is the purpose for the i’tikaf?

- What is the ruling for wiping on top of footwear during wudu’?

- What is the ruling for wiping over socks during wudu’?

- What is the ruling if nifaas blood after childbirth discontinues way before the typical 40 day postpartum period ends?

- What is the Sunnah for having the aqeeqa for a new born?

- What is the time period for clipping fingernails, toenails, and trimming or shaving mustaches?

- What nullifies wiping over footwear?

- What nullifies wiping?

- What should a person do if he cannot find any water or soil to purify himself with?

- When does the period for wiping over the khuf/socks begin?

- When is it obligatory to wipe?

- When should the siwaak be used?

- When would our Prophet (pbuh) begin his i’tikaf during Ramadan?

- When would our Prophet (pbuh) end his i’tikaf?

- Where and how should the footwear be wiped?

- Which is better in Ramadan: focusing on worship or seeking knowledge?

- What is the ruling for a Muslim on consuming gelatin in foods and medicines?

- What is the Islamic ruling on hearing the sound of an owl?

- Show all articles ( 101 ) Collapse Articles

-

Prayer/Salah

- How would a person with urinary incontinence purify themselves for prayer?

- If a person did not do their prayers in the past and now they want to commit to their faith and prayers, do they have to make up all the missed prayers for the previous past years?

- If a person suffers from poor memory and a lot of forgetfulness and gets confused in their prayers, Is their prayer valid?

- If I feel I let out gas during the prayer, should I stop praying and go out to renew my Wudu'?

- Is the Qibla in North America North-East or South-East?

- Is it Islamically permissible to pray the Jummah prayer on the school/work campus instead of going to the nearby Masjid?

- What time are the prayers?

- What is the Islamic Sunnah timeline to read Surah Al-Kahf on Friday?

- Can we pray Taraweeh or Night prayers while holding the Quran and reading from it? And can a person who does not understand Arabic praying Taraweeh behind the Imam hold the translation of the Quran to follow the Imam's recitation so they can understand?

- What are men required to wear during Islamic obligatory prayers (dress requirements, length, colors, images, writing, design, etc. )?

- Is it permissible to pray Jummah before the time of Dhuhur starts?

- Is The Qibla in North America North-East or South-East?

- How do we perform the Islamic Eclipse prayer?

- If I find that the congregational prayer has already started, can I pray the two Sunnah rak'ahs of Fajr after the obligatory prayer or wait until sunrise?

- Is it permissible for the same Imam to lead two Jumu‘ah (Friday) prayers on the same day, performing the first as his obligatory Jumu‘ah and the second as a voluntary (nafl) prayer while the congregation intends it as their obligatory Jumu‘ah?

- A woman who recently underwent abdominal surgery can stand in prayer, but experiences pain when bowing entirely for sujūd. Sitting for the prayer also causes discomfort when trying to lower the head. Is it permissible for her to place a pillow on the prayer mat or beneath it, and rest her head on it during sujūd? What is the Islamic ruling in such a case?

- In some communities, it is commonly claimed that performing salah in a garment that does not cover the area beyond the elbows (i.e., short sleeves) renders the salah makrūh (disliked). Is this ruling supported by authentic hadiths or reliable fiqh sources?

- Show all articles ( 2 ) Collapse Articles

-

Divorce

- Does this divorce count if a husband divorces his wife during her menses?

- Ruling on a wife requesting a divorce from her husband without a legitimate reason? Ruling on a wife staying with a husband who does not pray or fast?

- What constitutes a Khulu'?

- If a husband divorces his wife, can she leave the house and go stay with her parents during her waiting period?

- If a husband tells his wife our relationship is over and he sleeps in a different room, is this considered to be an Islamic divorce?

- If a wife gets divorced, does she still stay home during her waiting period (i'dah) or she is considered a stranger to her husband and needs to leave the house or stay and wear her Hijab in the house?

- Is there a waiting period for the husband to ask the wife back if he decides to? If so, how long is the period?

- What is the Islamic ruling on conditional divorce? For example, if you get pregnant again, I will divorce you.

-

Eid

-

Fasting

- Does blood donation break your fast?

- What is the ruling on using non-nutritive antibiotic eye drops and contact lenses solution (antibacterial and cleansing) while fasting?

- Are pregnant and nursing mothers allowed to not fast without making a prior attempt to fast?

- Are pregnant and nursing women able to break the fast? What is the evidence?

- Are the acts of excelling in family relations, maintaining good ties of kinship, increasing Qur’an recitation, and increasing charity to the poor, more preferred in Ramadan?

- Are there days that are haram to fast other than Eid days?

- Are there days that are haram to fast other than Eid days?

- Can a fast be broken by a traveling person who started traveling after fajr and during fasting hours?

- Can i’tikaf be done in any location, such as the home, a workplace, a hotel room, etc.?

- Can i’tikaf be done in any masjid?

- Do I make up the missed days of fasting, pay fidya, or both?

- Does a person who does not fast due to a chronic illness need to pay a kaffara?

- Does a person with a chronic illness need to attempt to fast?

- Does an elder automatically fall under the sick category?

- Does cupping invalidate fasting?

- Does having a blood test taken have any effect on the fast?

- Does the expiation for intercourse during the daytime in Ramadan have to be offered immediately, or can one take his time in offering it?

- Does the fidya need to be paid day by day or as a lump sum? and when?

- Fwd: too thirsty to fast ( Email with no Question) ??? Is it premissible to break our fast due to thirst and findding difficult without drinking anything?

- How do we end fasting the month of Ramadan if we start the fast in one place and end the fast in a different place?

- How does a pregnant or nursing woman determine if her own health will be compromised? Does she have to make an attempt to fast?

- How does a pregnant or nursing woman determine that the fast might harm her baby?

- How much is the Fidya for a person who cannot fast?

- How would a traveler make up the missed fasting days of Ramadan?

- I had sohoor intending that I was following my mobile app of athan time, then double checked IAR and discovered that fajer passed according to IAR time table. I committed to IAR schedule after that but my neighbor didnt know about this difference until the end of ramadhan. Do I need to re-fast? IAR has around a 15 min lead on fajer time than Ibad rahman and the athan app.

- If a husband fondles his wife and ejaculates semen/mani as a result, but she doesn't release any discharge, would that break her fast?

- If a man or woman breaks his/her fast in Ramadan due to a valid excuse - such as travel, illness, or menstruation, and later, outside of Ramadan, has spousal intercourse during the day when he/she was making up the Ramadan fast, is expiation required?

- If a person travels to another area with the intention of staying a very prolonged time, such as a student of knowledge traveling to the area from overseas and planning on staying several years, would he be allowed to take the concession of a traveler?

- If a woman has already paid the fidya on previous fasts without making up the days and she is now able to fast, what does she need to do?

- If a woman has more than one month of missed fasts due to consecutive pregnancy and can not fast the missed days, what should she do?

- If a woman wants to be safe from the difference of opinion of the scholars, which is the most cautious opinion she should take?

- If I take the conservative route and assume that the haram act was twice, thus 120 days would be required. Is it 120 consecutive days or two separate 60 consecutive day events? Also, remember you speaking of a limit (or amount of expiation days considered impractical?), but I can not find it in my notes. Can you refresh my memory?

- If one is in a state of janabah and does not perform ghusl before fajr time has entered, is his/her fasting valid?

- If the fasting of one who enters the day’s fast in a state of janabah is valid, how is the following hadith explained and does it pose a difference of opinion in the matter?

- In the case of expiation due to intercourse by means of feeding, is it required to feed sixty poor Muslim people or would it suffice to only feed one?

- Is a daily intention needed to not fast the subsequent days of the sickness?

- Is a person obligated to break their fast if they go on travel?

- Is an intention needed to break the fast on the initial start of the sickness?

- Is discharge during intercourse a requirement for a fast to be invalidated?

- Is expiation based on the order stated in the above hadith of the Prophet (pbuh) to the companion?

- Is expiation for having sexual intercourse during the daytime in Ramadan required for the husband and wife, or is it only required for the husband?

- Is intention required for every day in the month of Ramadan?

- Is it agreed upon by the scholars that cupping invalidates the fast?

- Is it agreed upon by the scholars that cupping invalidates the fast?

- Is it agreed upon by the scholars that food and drink substitutes, such as in the form of blood transfusions and drip nourishment, invalidate the fast?

- Is it allowed to take insulin while fasting?

- Is it permissible for a husband to kiss his wife while fasting and is it permissible for spouses to have foreplay while fasting?

- Is it permissible for a husband to kiss his wife while fasting? And is foreplay permissible between spouses while fasting?

- Is it permissible for a woman to take pills to prevent her menstrual cycle from appearing during Ramadan?

- Is it permissible for frequent travelers to break their fast?

- Is it permissible Islamically for a person to break his fast because his work schedule is difficult?

- Is it permissible to chew sugar-free/flavorless gum?

- Is it permissible to delay iftar slightly just to be on the safe side?

- Is it permissible to fast without suhoor?

- Is it permissible to intentionally gather one's saliva and swallow it to alleviate a dry mouth sensation for the fasting person?

- Is it permissible to start a voluntary fast and then break it without an excuse?

- Is it permissible to supplicate with duaa other than the authentic duaa from the Sunnah if one has not memorized the authentic duaa?

- Is it required to feed the 60 poor Muslim people at the same time?

- Is purification from janabah required to start the fast?

- Is the Duaa' accepted during fasting?

- Is the majority opinion strong enough to adopt pertaining to length of time allowable as a concession to a traveler?

- Is the requirement of expiation due to intercourse in Ramadan lifted for whomever is unable to offer it?

- Is the reward for feeding those who are fasting specific to the poor, or is it general and inclusive to family and friends?

- Is there an expiation required for any other invalidator of a fast?

- Is there fasting that is disliked?

- Is there fasting that is disliked?

- Mixed opinions on this and wanted to ask if you can combine the intention for making up days from ramadan and the 6 days of shawwal ?

- My wife had some missed days of fasting while pregnant and then nursing our sons. Can she give fidya/kaffara for those missed days ? she has missed 45 days and shes in her early 30's with two kids, 5 yrs and 10 months. What do you advise on how we proceed?

- Once the man gets to his destination at the hotel where he is traveling to, is he allowed to continue breaking the fast?

- Scenario: a traveler misses 5 days of fasting in Ramadan and dies 3 months later without making the days up. What should be done?

- Should a diabetic person fast?

- The traveler arrives back home in at 10am. Can he continue not fasting?

- What about blood tests and blood donations?

- What about the people who never break their Ramadan fasts despite having hardships? Would their fasts be invalidated?

- What about the timing of the start and end of the cycle?

- What about vaccines?

- What are legitimate reasons that allow someone to break an obligatory fast?

- What are recommended acts while fasting?

- What are sunnah acts of fasting?

- What are the conditions of fasting according to Hanbali?

- What are the conditions of fasting according to Shafi’i?

- What are the conditions of fasting due to Hanafi?

- What are the conditions of the fast according to Maaliki?

- What are the conditions that need to be met in order for a fast to be invalid?

- What are the days of voluntary fasting?

- What are the different types of fasting?

- What are the different types of fasting?

- What are the eight types of fasts according to Imam Hanafi?

- What are the eight types of fasts according to Imam Hanafi?

- What are the general rulings in the make up of the missed fasts?

- What are the general rulings on the permissibility of a pregnant or nursing mother to break the fast?

- What are the matters that invalidate the fast?

- What are the pillars and conditions of doing an i’tikaf?

- What are the pillars of fasting?

- What are the pillars of fasting?

- What are the prerequisites of fasting?

- What do I do if I am pregnant and/or nursing and cannot fast?

- What does an elder need to do if they can't fast?

- What if a traveler had a legitimate reason for not being able to make up missed fasts before the next Ramadan?

- What if a traveler has no legitimate reason for not being able to make up missed fasts before the next Ramadan, such as due to laziness and procrastination?

- What if he does not know ahead of time how long the trip will last? Can he break his fast the entire length of time?

- What if he knows ahead of time that the trip will last more than 4 days?

- What if the above case was for non-Ramadan fasts, such as fasting on Mondays and Thursdays and the six days of the month of Shawwal?

- What if the medical condition is not chronic and not lasting?

- What if the student travels back and forth during that time period from the area to his home country?

- What is a fifth invalidator of the fast and what is the evidence for it?

- What is a fourth invalidator of the fast and what is the evidence for it?

- What is a second invalidator of the fast and what is the evidence for it?

- What is a seventh invalidator of the fast and what is the evidence for it?

- What is a sixth invalidator of the fast and what is the evidence for it?

- What is a third invalidator of the fast and what is the evidence for it?

- What is an eighth invalidator of the fast and what is the evidence for it?

- What is Fidya of not being able to fast?

- What is i’tikaf?

- What is Ikrah?

- What is meant by wisal (connected fasting) and what is its ruling?

- What is the definition of a sickness which allows a person to break their fast?

- What is the definition of travel?

- What is the detailed analysis of the fifth opinion which states that the pregnant woman needs to only make up the missed days and the nursing woman needs to make up the days and pay a fidya?

- What is the detailed analysis of the first opinion that states that a pregnant or nursing woman only has to make up the missed days?

- What is the detailed analysis of the fourth opinion which states that the pregnant or nursing woman does not need to make up the days and nor does she need to pay a fidya?

- What is the detailed analysis of the second opinion which states that a pregnant or nursing woman only needs to pay the fidya of feeding one needy Muslim person per missed day?

- What is the detailed analysis of the third opinion which states that a pregnant or nursing woman needs to make up the missed days and pay the fidya?

- What is the difference between a wrong action of a fasting person that is done out of forgetfulness versus someone who does a wrong action by mistake?

- What is the duration of the fast?

- What is the duration of the fast?

- What is the evidence as to why a menstruating woman needs to make up for her missed fasts but not for her prayers?

- What is the evidence for one who takes the opinion of fasting according to the horizon in one's region?

- What is the evidence for those who take the opinion of unifying the commencement of fasting and just using one horizon as reference?

- What is the evidence that travel is a legitimate reason that allows a person to break his/her fast during Ramadan or an obligatory fast?

- What is the expiation for a wife whose husband has intercourse with her without her consent?

- What is the expiation for spouses who have intercourse during the daytime in Ramadan due to desire that stemmed from both of them?

- What is the expiation if one or both spouses discharge mani as a result of sexual arousal?

- What is the Islamic definition of fasting?

- What is the Islamic definition of fasting?

- What is the methodology in confirming the sighting of the Ramadan moon according to Imam Hanafi?

- What is the methodology in confirming the sighting of the Ramadan moon according to Imam Hanafi?

- What is the methodology in confirming the sighting of the Ramadan moon according to Imam Hanbali?

- What is the methodology in confirming the sighting of the Ramadan moon?

- What is the ruling for a man who has intercourse with his wife during the daytime in Ramadan out of forgetfulness?

- What is the ruling for a person who works at a physically demanding job, such as construction, which can result in extreme exhaustion and dehydration?

- What is the ruling for one who has anal intercourse with his wife during the daytime in Ramadan?

- What is the ruling for one who repeats intercourse in Ramadan?

- What is the ruling for pregnant women who are advised not to fast by their Muslim doctors due to the nature of the pregnancy and its possible affect on the baby?

- What is the ruling for spouses who have intercourse during the day in Ramadan while traveling?

- What is the ruling for those fighting for the sake of Allah?

- What is the ruling if a fasting person eats, drinks, or has sexual relations with their spouse out of forgetfulness?

- What is the ruling if a fasting person needed to soften their miswak with water before using it and some of the water got mixed with the saliva and was swallowed?

- What is the ruling if a man gets sexually stimulated through no action on his own (he did not touch any body part, but he may have unintentionally come across an image that aroused him) and discharges mani?

- What is the ruling if a man wakes up after fajr time and finds out he had a wet dream or who unintentionally has a wet dream during the day in Ramadan?

- What is the ruling if a person does wudhu outside of the prayer time with the intention of refreshing his/her dry mouth?

- What is the ruling if a person with sinus issues has mucus build up and they feel that they are swallowing that mucus?

- What is the ruling if nifaas blood after childbirth discontinues way before the typical 40 day postpartum period ends?

- What is the ruling if someone breathes in dust, dirt, or pollen from the air?

- What is the ruling of taking multiple showers (or swimming) while fasting in order to rejuvenate a dehydrated body due to fasting in excessive heat while working?

- What is the ruling on a woman's fast if her husband forced her into intercourse during the day in Ramadan?

- What is the ruling on fasting the month of Ramadan?

- What is the ruling on fasting the month of Ramadan?

- What is the ruling on how a pregnant or nursing woman can make up for the missed fasts if the days were missed on account of fear of harm to her baby?

- What is the ruling on how a pregnant or nursing woman can make up for the missed fasts if the days were missed on account of her own health?

- What is the virtue of i’tikaf in the month of Ramadan?

- What is voluntary (nafl) fasting?

- What is voluntary (nafl) fasting?

- What should a Muslim say at the sighting of the new moon (of the lunar month)?

- What should they do in this situation?

- When is a pregnant or nursing woman eligible to break the fast?

- When is an elder exempt from fasting?

- When is fasting obligatory?

- When is he allowed to start breaking his fast?

- When should fasting commence if there is a difference in the horizon in one place versus another?

- When someone is fasting as Kafara (expiation) consecutive 60 days, but the same normal exemptions apply to breaking the fast. Just so that I am clear, am I allowed to break the fast due to travel for example and resume the fasting after travel is completed and still be considered consecutive?

- When would our Prophet (pbuh) begin his i’tikaf during Ramadan?

- When would our Prophet (pbuh) end his i’tikaf?

- Which conditions of fasting have all the scholars agreed upon?

- Which is better in Ramadan: focusing on worship or seeking knowledge?

- Which is the most serious invalidator of a fast and requires an expiation?

- Which matters do not invalidate a fast?

- Which matters that invalidate the fast are specifically mentioned in hadith?

- Which matters that invalidate the fast are specifically mentioned in the Qur’an?

- Which opinion is best to follow?

- Who needs to pay Fidya?

- Would a man’s fast be broken if he kisses his wife and her saliva mixes with his?

- Would quarreling or using obscene language during fasting invalidate one’s fast?

- Is it Islamically permissible to use perfumes while fasting in Ramadan?

- If someone forgets to turn off the humidifier on a CPAP machine while fasting, does that invalidate the fast?

- Is having the medical condition of GERD a valid reason not to fast?

- At what time should I break the fast?

- Do Nicotine Patches used to help quit smoking break the fast during Ramadan?

- Show all articles ( 173 ) Collapse Articles

-

Financial Transactions

- Are all IRAs restricted like the 401(k) with the same Zakat rulings?

- Are all IRAs restricted like the 401(k) with the same Zakat rulings?

- Are gifts and cash incentives offered by banks to account holders Islamically permissible?

- Are student loans Islamically permissible?

- Can I give the interest money to relatives/friends of mine who are considered poor? And do I have to inform them?

- Can I use the interest money to pay my student loan or my utility bills?

- Do we pay Zakat on 401k before the due date matures?

- Do we pay Zakat on 401k before the due date matures?

- Is investing in 401k permissible in Islam?

- Is investing in 401k permissible in Islam?

- Is it allowed for me to use the interest money accumulated in my bank account?

- Is it permissible in Islam for a person to take a loan on his own 401k and pay it back with interest?

- Is it permissible to invest in Cryptocurrencies, specifically Bitcoin?

- Is it permissible to purchase a house if the seller and the lender are the same entity?

- Is it permissible to transfer an interest-based debt to a non-interest based debt or to a 0% interest rate debt, so the interest can be reduced or eliminated? If permissible, can I do it for one of my family members using my card?

- Is working at a bank Islamically permissible?

- Is Zakat owed on retirement accounts, such as a 401(k)?

- Is Zakat owed on retirement accounts, such as a 401(k)?

- Should a long-term debt be returned on the due date for the amount previously borrowed or its current value today?

- What can Interest/impermissible money be spent on? Can you give interest money to charity in Islam?

- What if a person owes Zakat to a retirement account but does not have the cash liquidity to pay from their available wealth?

- What if the 401(k) account imposes restrictions and penalties if withdrawn prematurely?

- What if the 401(k) account imposes restrictions and penalties if withdrawn prematurely?

- What is the argument for paying Zakat on restricted accounts?

- What is the argument for paying Zakat on restricted accounts?

- What is the best way to get rid of the interest money?

- What is the Islamic ruling on buying additional warranty coverage for electronic products?<br>Also, is it permissible to work at a store that sells these extended warranties?

- As the majority of graduate programs provide unsubsidized loans, AMJA deems this impermissible due to the loan pertaining interest. The link states that unsubsidized loans are haram based on their own merit and can only be permissible in a state of necessity. The article then states that further investigation is needed as it has not been determined the point in which university education can be considered a necessity that allows for interest bearing loans. My question is where to go from here? I want to achieve higher education to provide a sustainable life for myself and future family insha Allah and not being able to have the means to do so because of America's interest system is saddening. Do Muslims that want to achieve a higher education but cannot afford it just stop going to school? How do Muslims work towards the positions in which they feel they can make a difference if interest based loans are preventing them from receiving the credentials society deems needed to be in those careers?

- Can I make permenant charity (Sadaqa) for my late husband?

- I have a question regarding refinancing my home. I bought my home from a builder then as expected they sold the loan to another loan company after few months. Now with the interest rate is lower than before, is it permissible to do refinancing from same lender I am with or another lender to reduce my payment?

- if there is a way he can donate the weight of the baby's hair in actual gold instead of cash?

- In Islam, if you borrow money from someone you are required to pay them back. What if someone offers to buy you something and they say that you do not have to pay them back? Are you still held accountable for paying back that debt, even if the person says that you are not required to?

- Is investing in the stock market permissible in Islam?

- Is it haram to shop for your son for clothes online?

- Is it haram to shop online for your husband (in regards to clothes)?

- Is it permissible to issue a credit card and is the ruling on accepting cash rewards?

- is it permissible to receive money from online jobs that pay you to take surveys? Many sites pay you to give your opinion on a product or take a survey.

- Is using a credit card to fund my Umrah trip permissible in Islam?

- Should I take the interest money accumulated in my bank account, or should I leave it to the bank?

- What is the Islamic ruling on options contracts on shares/stocks?

- Is it permissible to buy or sell something at a specific price at a specific time; for example, to agree with someone to sell something for ten dollars on the thirty-first day, where my profit or loss will depend on the price of this thing at that time, and the same applies to buying?

- Is it permissible to receive cash back from a credit card company?

- Show all articles ( 27 ) Collapse Articles

-

Food & Drink

- Is fermented food or drink halah?

- Is it Islamically permissible to eat squirrel meat as a treatment for asthma and shortness of breath?

- Is it permissible to sell the meat of the Udhiyah?

- Is Seafood halal?

- What is the difference between Zabiha and Halah meat? Which one is permissible to eat?

- What is the Islamic ruling on enzymes in cheese?

- Is it halal to use red wine vinegar for consumption?

- Is It Islamically permissible to use a mouthwash that contains alcohol?

- Is it Islamically permissible to use a mouthwash that contains alcohol?

- Is it permissible to eat the testicles of slaughtered animals? And is it permissible to eat the testicles of animals alive?

- It is not permissible to deliberately add alcohol to the drink or food even if it evaporates because the essence of the alcohol is still present and has not been fully absorbed into the food with which it is mixed, and its effect on the food remains apparent?

- What is the difference between Zabiha vs. Halal meat, and which one is permissible to eat?

- What is the ruling for a Muslim on consuming gelatin in foods and medicines?

- Is it permissible in Islam to feed my pet cat non-Zabiha meat, such as chicken or beef-based canned cat food, from a store like Petsmart?

- What is the Islamic ruling on consuming foods prepared with beer batter, such as fried fish or chicken, where beer is used as part of the cooking process?

-

Funeral/Janaza

- Can the Salatul Janazah (funeral prayer) be performed inside the masjid?

- Can women pray Salatul Janazah (funeral prayer)?

- Can you give us more details on "Salatul Janazah"?

- How is Tayammum [dry wash] performed for the dead person?

- How is the "Salatul Janazah" performed?

- How is the bathing of the dead (Ghusl) carried out?

- How is the Islamic burial actually carried out?

- How is the Kafan (the shroud) prepared and placed?

- How should the preparations begin for the Islamic burial?

- Prohibited acts while visiting graves

- What are important things that family members and friends should do when someone is dying?

- What are some of the things one SHOULD NOT DO during the Janazah (funeral)?

- What are the rules concerning the carrying of the coffin?

- What are the rules concerning the visitation of graves?

- What kind of things can be done that would benefit the dead?

- What should family members and friends do immediately after the death of their loved one?

- What should the relatives and members of the community do to comfort the family of the dead person?

- When can Tayammum [dry Wash] be performed on the deceased?

- Show all articles ( 3 ) Collapse Articles

-

Hajj/Umrah

- If a person who is performing Umrah takes a break from saying the Talbiya and starts socializing and joking for some leisure?

- If one who is performing Umrah loses his ablution (Wudoo’), does he have to maintain his ablution (Wudoo’) to say the Talbiya?

- If something happens to a person in a state of Ihram that prevents him from performing the Umrah and he forgot to make the condition during his intention for Ihram, what does he need to do?

- If the place of residence has a strong fragrance that leaves a trace on the body or clothes of a person performing Umrah, what is required of him?

- Is it permissible to chant the Talbiya?

- Is it permissible to cover the face with clothes or a mask from dust or the smell of car exhaust smoke?

- Is it permissible to shower before Umrah?

- Is it permissible to use cleansing products with fragrances while showering?

- Is there a ransom (Fidyah) on one who slept the majority of the way and only said the Talbiya for a short while?

- Prohibitions for the one in a state of Ihram - What is meant by prohibitions?

- What is the merit of performing ‘Umrah during the blessed month of Ramadan?

- What is the ruling in changing Ihram clothes for a man or a woman due to sweat or uncleanliness?

- What is the ruling on postponing the performance of Umrah due to exhaustion from the long journey?

- What is the ruling on using deodorant for a person in the state of Ihram?

- A person has monthly scheduled debt payments that are being paid on time - can he go to 'Umrah?

- A person performing 'Umrah is traveling by plane and has been informed that he will pass above the Meeqat in thirty minutes, but he made the intention and started the Talbiya shortly before the Meeqat - is that considered a problem?

- A person wants to send his parents to 'Umrah from his money first before he goes to 'Umrah himself - is this action permissible?

- Are women required to say Talbiya like men?

- Do all the prohibition acts during the state of Ihram require a sacrifice?

- Do women need to perform ‘Umrah, or is it an act prescribed specifically for men?

- Does sin and ransom (Fidyahh) always apply to any person who does a prohibited act during the state of Ihram?

- Due to the speed of the airplane, a person who is performing 'Umrah was a little late in verbalizing his intention, saying the Talbiya, and wearing the Ihram attire; and he did not do so except after he passed the Meeqat - what is the ruling in his doing?

- For one who chooses to do the compensatory fasts, is it obligatory that he performs the fasts in Makkah?

- How does one vocally commence the Umrah rituals?

- How is the Meeqat related to the rituals of 'Umrah?

- If a person has an outstanding loan, does he have to seek the permission of the creditor in order to be able to travel and perform 'Umrah?

- If a person performing Umrah rubs his head and some hair falls out, is he required to do anything?

- If a woman fears that her voice may be a source of temptation(fitna), what should be done?

- If one accidentally was biting his nails out of forgetfulness, what is the ruling for that?

- If the doctor orders any patient not to perform 'Umrah, should he obey the doctor’s order?

- If the money saved for 'Umrah cannot cover but one thing - paying the debt installment or 'Umrah, which should come first?

- Is it permissible for a man in the state of Ihram to approach his wife in foreplay physically or verbally?

- Is it permissible for a sick person with a fever to place cold compresses on his head due to the pain?

- Is it permissible for a woman to wear gold during Umrah?

- Is it permissible for one who has financial difficulty to go to 'Umrah from Zakat money?

- Is it permissible for the one in a state of Ihram to clip a nail that is on the verge of breaking,

- Is it permissible for the one performing Umrah to use an umbrella while he is in a state of Ihram?

- Is it permissible for the one who sacrificed a sheep to eat from it?

- Is it permissible to perform Istikhara before going to 'Umrah?

- Is it permissible to say the Talbiya with supplications that the Prophet (ﷺ) did not say?

- Is it permissible to use the Siwak or a toothbrush for the one in a state of Ihram?

- Is it permissible to wear the Ihram attire from home, before getting on the airplane?

- Is it preferable to raise one’s voice while saying the Talbiya or saying it quietly?

- Is the Talbiya said individually or in a congregation?

- Is there a difference in punishment between leaving out an obligation and doing an act that is prohibited during the state Ihram?

- Is using a credit card to fund my Umrah trip permissible in Islam?

- Must the Muslim use his personal money to go on 'Umrah?

- Should a woman buy new Ihram clothes for Umrah?

- Should one who desires to perform 'Umrah know its rulings?

- What are the general prohibitions to be avoided during the state of Ihram that are shared between men and women?

- What are the mandatory acts of 'Umrah?

- What are the meaning of the words that are in the Talbiya?

- What are the pillars of 'Umrah?

- What are the pillars of 'Umrah?

- What are the preferred acts of 'Umrah?

- What are the preferred acts of 'Umrah?

- What are the recommended acts to be performed prior to entering the state of Ihram of 'Umrah?

- What are the requirements of 'Umrah?

- What does one do if some perfume accidentally got on his body or clothes while he is in Ihram?

- What is meant by the Meeqat?

- What is the format of the Talbiya?

- What is the meaning of our saying: “Laybbaka Allahuma Labbayk” (”Here I am, O Allah, here I am”)?

- What is the merit of repeating ‘Umrah?

- What is the merit of Talbiya?

- What is the permissibility of a pregnant woman going to 'Umrah?

- What is the reward of one who dies in a state of performing ‘Umrah

- What is the reward of one who gives to a person who cannot afford to go to 'Umrah?

- What is the ruling for a man to cover his feet while he is sleeping when he is in the state of Ihram and performing Umrah?

- What is the ruling for a woman raising her voice in Talbiya?

- What is the ruling for one who committed more than one prohibition during the state of Ihram?

- What is the ruling in mixing the Talbiyah with tahleel (La illaha ila Allah) and takbeer (Allahu Akbar)?

- What is the ruling on borrowing money to perform 'Umrah?

- What is the ruling on Talbiyah?

- What is the ruling on the use of creams during the state of Ihram?

- What is the wisdom in having more than one Meeqat around Makkah?

- What marks the commencement of Umrah?

- What type of arguments are prohibited during the state of Ihram?

- When does the time start from abstaining from the prohibitions?

- If a woman wants to go to Hajj and her father as her mahram, and has the money to go to pay for Hajj, but she has small children, one the age of 4 years and twins the age 1 year, is she obligated to go to Hajj, or are the small children an excuse for her?

- A man was given a sum of money by a non-Muslim, and he performed Hajj and Umrah with it. What is the ruling on his Hajj/Umrah?

- What is prohibited for the Muhrim (person in a state of Ihram) in terms of clothing, and is wearing a face mask prohibited?

- Is it permissible for a menstruating woman to enter the state of Ihram before the Meeqat without praying the two Rak’at of Ihram?

- Is it permissible for a menstruating woman to do Dhikr (remembrance of Allah SWT)?

- What does a woman do if she intended Hajj or Umrah and then started her menstrual cycle prior to reaching the Meeqat?

- During Hajj and Umrah, a woman who starts menstruating is afflicted with severe sadness and despair- what should we tell her?

- What does a menstruating woman do after she enters the state of Ihram and arrives to Makkah?

- What does a woman do if she entered the state of Ihram while she was pure, passed the Meeqat, performed Tawaf whilst pure then started menstruating after she finished her Tawaf and right before she started Sa’i?

- If a woman started menstruating before or after entering the state of Ihram and did not perform Tawaf for Umrah or Tawaf-ul-Ifada for Hajj and her Mahram/group with whom she traveled must leave to return to their country, what does she do?

- Is it permissible for a menstruating woman to enter the sacred Masjid in Madina and Makkah?

- A Muslim expresses a sincere desire to perform ‘Umrah, but currently works in a field related to finance and the cannabis industries, which often include impermissible elements under Islamic law. The work supports two families, and leaving it would create financial hardship. Given these circumstances, is it appropriate to perform ‘Umrah? What advice can help ensure sincerity and that the journey is pleasing to Allah ﷻ?

- Show all articles ( 75 ) Collapse Articles

-

Inheritance

- Are there any restrictions to gift giving during one’s lifetime?

- Can a person distribute their estate before they die if there is a legitimate reason?

- Can Muslims inherit from non-Muslims?

- Can Non-Muslim family members inherit from Muslims?

- Do adopted children inherit as biological children?

- Do we have full ownership of our property and possessions?

- If all heirs are in full agreement to voluntarily distribute the estate in different shares than what is specified in the Quran, can they do that?

- If the estate gets distributed before or after death and the distribution was not according to the Islamic law as Allah specified in the Quran but mainly was distributed unfairly, what should be done with such distribution?

- Is disinheritance of beneficiaries allowed in Islam?

- Is gift giving allowed in one’s lifetime?

- Is Islamic Inheritance ordained in the Qur’an?

- Is it Islamic to give everything to your spouse, assuming your spouse will distribute it fairly?

- Is it obligatory to follow the rules of Inheritance as outlined in the Qur’an?

- Is this system of inheritance agreed upon among all Sunni schools of thought?

- What are the proper Islamic steps that should be taken before the distribution of money after death?

- What is a Wassiyyah?

- What is the overview of this specified system of inheritance distribution?

- What is the religious source for the Islamic formula of distribution?

- Who are the beneficiaries of the Islamic inheritance distribution?

- Why is there a difference in share distribution between sons and daughters?

- Can a gift be given to a person who is not part of the heirs?

- Can one of the heirs give up their rights of inheritance to other deserving members?

- My great grandmother passed away earlier this year and I have been thinking about building a drinking well in her name. If the well is built in her name even though she is not the one assisting to have it built would she receive the blessings from this well?

- What is an Islamic Wassiyyah?

- When should the distribution of inheritance take place?

- Show all articles ( 10 ) Collapse Articles

-

Jobs & Works

- Is it permissible to invest in Cryptocurrencies, specifically Bitcoin?

- Is there a prohibition on selling dogs in Islamic law?

- What is the Islamic ruling on owning or working in restaurants where wine or pork is served?

- What is the ruling for renting out space in a store for someone that sells alcohol, and the store owner is not taking any percentage from the alcohol?

- I have a job as a sales copywriter for a business that mainly sells generic children's toys, but during holidays like Halloween and Christmas, they sell toys with those themes/decorations. Is it permissible for me to write advertisements for these holiday toys?

- I have been told by various people that working in grocery stores is haram because of the cigarettes and alcohol sold. Is this true?

- is it haram to enter competitions to win money?

- Is it Islamically permissible to work at a place that sells alcohol, pork, and lottery tickets if that is the only job I can find?

- Is It Islamically permissible to work in a job that supports and promotes stability in the LGBTQ community?

- is it permissible to work in a pharmacy, even though it may sell alcoholic/tobacco products? What are some examples permissible halal jobs, or which the money earned is halal?

- Is working at a bank Islamically permissible?

- Is it permissible for a Muslim doctor in the West to buy indemnity insurance?

- Is it permissible (ḥalāl) to work as a driver at UPS, knowing that the job involves delivering a wide range of products, but occasionally includes items that are ḥarām, such as alcohol? While most of the job serves the community and provides a public benefit, I am concerned about the Islamic ruling on handling prohibited items in some deliveries.

-

Manners & Ethics

- Are men and women allowed to interact together in Islam?

- Are tattoos haram? Why?

- I am a nurse and have to sometimes expose the 'Awrah (including private parts) of the opposite sex. Is this Islamically permissible?

- I work as a tax associate. I fill out the data for companies and individuals; interest is subject to taxes, and sometimes we have to enter interest information (profit and loss) while filling in data. Does this fall under the Hadith of the usury writer and its two witnesses?

- Is circumcision for males obligatory in Islam?

- Is it Islamically permissible to practice "yoga" exercises?

- Is it Islamically permissible to use braces on the teeth or to get an Invisalign, which is a clear dental brace for teeth that helps to align teeth and close the gap between the two front teeth?

- Is it permissible for a Muslim person to financially support and vote for a political candidate who publicly supports and endorses LGBT rights?

- Is it permissible to play board games where dice are involved?

- Is it permissible to wear a shirt with a picture/logo on it?

- Is mercy killing (Euthanasia) of animals permissible in Islam?

- Is my job income pure and halal despite the fact that I cheated in college to acquire my degree? However, my sole work now is heavily dependent on my experience and not my degree?

- Is smoking permissible in Islam? Is selling cigarettes permissible in Islam?

- Is smoking permissible in Islam? Is selling cigarettes permissible in Islam?

- Is wearing gold permissible for men?

- What is the Islamic ruling on masturbation?

- What is the Islamic ruling on naming our children with the names of angels?

- Are sexual acts leading to Zina(fornication) with a non-wife woman considered Zina that constitutes the hadd (corporal) punishment?

- I have scheduled eye surgery for Glaucoma and the doctor is going to implant a gelatin stent inside the eye that is made of pig gelatin, is this Islamically permissible?

- Is bargaining during a purchase of goods considered among the aggressive/prohibited arguments?

- Is celebrating or attending a birthday party permissible in Islam?

- Is it allowed in Islam for a woman to ride a bike or motorcycle?

- Is it halal to draw 3D pictures of humans and animals if I draw the head but without resembling a real human being's face?

- Is it Islamically permissible to practice boxing?

- Is It Islamically permissible to work in a job that supports and promotes stability in the LGBTQ community?

- Is It permissible in Islam to cut off my relationship with an abusive Dad?

- Is it permissible Islamically to shave my beard or trim it?

- Is it permissible to wear a shirt with a picture/logo on it?

- What are Islamic procedures & protocols for receiving a newborn baby?

- Can the dead hear us?

- Can women visit the dead at a cemetery?

- I have a terminally ill pet and am preparing for the appropriate handling of its body after its passing. I understand that Islam favors burial for both humans and animals. I do not feel comfortable with cremation due to its contradiction with Islamic values. However, I wish to keep my pet’s remains with me and worry about relocating in the future. Would it be permissible to opt for aquamation (alkaline hydrolysis), a process involving water instead of fire, which returns the remains as bone dust? Would it be Islamically permissible to keep the ashes at home, provided they are not being used or repurposed?

- Show all articles ( 17 ) Collapse Articles

-

Marriage

- Is it Islamically permissible to talk to my fiancée over the phone?

- Is it permissible for my daughter to forsake her dad's presence and consent to her Nikkah since he is an abusive dad?

- Is it permissible to marry a person who committed zina and other sinful acts in the past but sincerely regretted the acts and repented?

- Is marriage with the agreement of the woman and her wali along with witnesses being present, but without announcing the marriage publicly, or registering it in the Islamic or civil courts, considered to be a valid Islamic marriage?

- Is reducing the mahr in Islam from the tradition of our beloved Prophet PBUH?

- Is temporary marriage permissible in Islam?

- If an unmarried woman commits Zina with a man and becomes pregnant, can they get married (nikkah) right away after the baby is born, or do they have to wait three months?

- If we have a close family or friend who is entering an impermissible marriage (such as Muslim man marrying a polytheist, a Muslim woman marrying a non-Muslim man, or same sex marriage), and they know it is impermissible in Islam, should we avoid attending their wedding? If there is a worry that not attending would lead them even farther from Islam. Would the fact that one of the maqaasid assharia is preserving faith in Islam be a valid rationale to attend the wedding with the intention of showing love to attract them both to Islam?

- Is It permissible for my daughter to forsake her father's presence and consent to her Nikkah since he is an abusive or just a negligent father?

- What are the pillars that make an Islamic marriage contract valid?

-

Quran/Hadith

- Is it permissible in Islam to buy and sell the book of Qur'an?

- Is It permissible to read Quran regularly on behalf of deceased Muslims?

- Is it permissible to receive a financial gift for teaching the Qur’an? If one does receive such a gift, must one give it away to charity?

- Is Taharah (purity) a condition before one starts reciting the Quran?<br>Is reading Qur'an from a phone app permissible while not being in a state of purity?

-

Taharah-Purification

- A woman is currently clear and feels the sign of an upcoming period. Asr time comes in at 4pm and she is making wudu at 4:05pm. During wudu she feels wetness and notices the discharge. Does she need to make up the prayer?

- Can all activity be resumed during istihatha?

- How do we purify things?

- How does a woman with istihatha pray?

- How does one perform tayammum?

- Is circumcision for males obligatory?

- Is there a kaffara for having intercourse during menses?

- Is there an exception to the impermissibility of making tawwaf while on menses?

- Scenarios for resuming prayer after menses (according to the opinion that all previous daytime or nighttime prayers of the last day need to be done)

- What are actions that require wudu’ that are agreed upon by Muslim jurists?

- What are actions that require wudu’ that are disagreed upon by Muslim jurists?

- What are actions which require ghusl (bathing) that are disagreed upon by Muslim jurists?

- What are nullifying acts of wudu’ that are agreed upon by Muslim jurists?

- What are nullifying acts of wudu’ that are disagreed upon by Muslim jurists?

- What are obligatory acts of wudu’ which are agreed upon by the Muslim jurists?

- What are other matters related to ghusl?

- What are other notes concerning wudu’?

- What are prohibited acts for one in a state of major ritual impurity that are agreed upon by Muslim jurists?

- What are prohibited acts for one in a state of major ritual impurity that are disagreed upon by Muslim jurists?

- What are the actions for which wudu’ is preferred?

- What are the nullifiers of tayammum?

- What are the obligatory actions for ghusl that are agreed upon by Muslim jurists?

- What are the obligatory actions for ghusl that are disagreed upon by Muslim jurists?

- What are the pillars of ghusul?

- What are the reasons for the permissibility of tayammum which are agreed upon by the Muslim jurists?

- What are the reasons for the permissibility of tayammum which are disagreed upon by the Muslim jurists?

- What are the recommended actions for ghusl in order to adhere to the actions of the Prophet pbuh?

- What are the recommended sunnah acts of wudu’ (ablution)?

- What are the times and events for which ghusl is preferred?

- What did our Prophet pbuh say about the characteristics of al-Fitrah?

- What if 40 days of nafas passes? Is that blood considered hayth or istihatha?

- What if 40 days of nafas passes? Is that blood considered hayth or istihatha?

- What if a woman is currently clear but she feels a sign of an upcoming period?

- What if a woman wants to take repeated ghusl throughout her istihatha period?

- What if she clears nafas blood before 40 days?

- What if the husband has intercourse with his wife during menses?

- What is hayth?

- What is istihatha?

- What is nifaas?

- What is tayammum?

- What is the definition of clearance of menses?

- What is the description of demm al nafas (nafas)?

- What is the duration of nafas blood?

- What is the Islamic ruling on masturbation?

- What is the length of the hayth (menses)?

- What is the ruling for a pregnant woman who still experiences bleeding?

- What is the ruling in the case of young females who are starting their cycles? In the beginning, it may take a few months or years to establish a regular cycle.

- What is the time period for shaving pubic hair and pulling out underarm hair?

- What should a person do if he cannot find any water or soil to purify himself with?

- When are the times in which the prayers are prohibited to be performed?

- When is ghusul obligatory?

- Which activities does hayth prevent?

- Why is it important to know the minimum/ maximum length of the hayth and the emergence of the istihatha?

- A pregnant woman with bleeding doesn't fall under the rulings of hayth blood. So she doesn't need to do ghusl after she clears. But what if she doesn't feel comfortable not doing ghusl?

- Can a person pray a voluntary prayer while the obligatory one is in session?

- If a sister makes wudu and puts on a under-scarf and then hijab over it before she leaves the house, does she need to wipe over under-scarf or the hijab when making wudu for prayer?

- Is it allowed for women to take medicine to delay their menses?

- Is it better to wipe over the socks or to wash the feet while being at home?

- Is it permissible for a man to grow his hair long and braid it? Does a woman/man have to undo their braids when performing ablution-wudu- or taking a full bath-ghusl?

- Is it permissible to wipe over the socks when making Wudu'?

- Is there any evidence of the scholars' limitations of the minimums and maximums of menses?

- Once a woman clears from her menses, which prayers is she responsible for on the day of her clearing? Is this opinion agreed upon by scholars?

- Should wiping over hijab only be done out of necessity and removed for wudu if one is able to?

- The scenario that can occur with menstruating women: A woman who has a regular, consistent cycle has her usual discharge and she clears after her usual amount of days. What should she do?

- The scenario that can occur with menstruating women: A woman who typically has an irregular cycle, and after 7 days, the type of blood being discharged now is different from the hayth blood. Different color, consistency, etc. Does she need to wait until the maximum days are met, or can she resume praying?

- The scenario that can occur with menstruating women: What does she do if she is still discharging istihatha after a maximum of 15 days?

- The scenario that can occur with menstruating women: What if a woman normally has a typical menses (heavy discharge, etc), but due to circumstances, such as diet or travel, her cycle changed and became just spotting and without her regular physical symptoms? Is this still hayth?

- The scenario that can occur with menstruating women: What if after reaching the maximum length, she is still discharging the hayth blood? What should she do?

- The scenario that can occur with menstruating women: What if she has a regular monthly period but one month she has only spotting but it's at the regular time of her typical cycle and with the same physical symptoms? The only difference is the type of discharge.

- The scenario that can occur with menstruating women: What if she is not on travel and goes through stress/anxiety, and her monthly cycles (after the first time) become different?

- The scenario that can occur with menstruating women: What if the woman doesn't have a regular menses (heavy discharge of blood, smell, cramps), but she has spotting each month or very light blood?

- The scenario that can occur with menstruating women: What is the ruling for a woman who typically has a cycle of 7 to 10 days, but due to external factors, her cycle changes? For example, it stops after 2 days and then comes back 2 days later?

- What are the etiquettes when utilizing the bathroom?

- What are the obligatory acts of wudu’ that are disagreed upon by the Muslim jurists?

- What are the times of the Prayers?

- When is the cut-off time for each Salah to be performed?

- When making wudu does a sister need to wash the ears if the under-scarf covers the ears?

- When must the prayer be performed when sleeping through or forgetting the Prayer?

- Show all articles ( 63 ) Collapse Articles

-

Women

- Are tampons permissible to use for unmarried girls/virgins? If they are not permissible to use, what should a girl do?

- Can a woman visit her husband's grave while still on her 'iddah period?

- Can women travel without a mahram (a male relative she can not marry)?

- Does bleeding during consummation prove that the girl is a virgin in Islam?

- Does Islam require a woman to change her maiden name and take her husband's last name?

- Does Quran/Islam prohibit a Muslim woman from marrying a non-Muslim man?

- Is abortion allowed in Islam if the fetus is malformed?

- Is breathable nail polish permissible to use so I can avoid taking it off before Wudu?

- Is hijab a religious or cultural practice?

- Is It Islamically permissible for a woman to go out of her house without a mahram male guardian?

- Is it Islamically permissible for women to get botox injections for the reduction/prevention of wrinkles?

- Is it permissible for a female to have body piercings? What is the ruling if these piercings were before becoming Muslim?

- Is it permissible for a Muslim woman to work at a massage place that caters to both genders?

- Is it permissible for a woman to cut her hair short?

- Is it permissible to use lipstick with carmine in it? How about blushes or eyeliners?

- Is wearing makeup and jewelry In public allowed in Islam?

- Islamically, when does a woman's menstruation period end?

- What if she has to attend very important events pertaining to her family members?

- What is a woman's ‘iddah period following her husband’s death?

- Are Muslim women allowed to live on their own, especially if they are financially independent, or must they live with their parents?

- If an unmarried woman commits Zina with a man and becomes pregnant, can they get married (nikkah) right away after the baby is born, or do they have to wait three months?

- Is it permissible for a woman to have intercourse with her slave, and is it allowed to bring slavery back?

- When a woman cannot conceive a baby, doctors give the option to get an egg from a donor and implant it in her, with her husband's sperm. Then she will be pregnant. Is that halal?

- Can a woman pray after a miscarriage?

- Is it haram to choose not to have children?

- Is it Islamically allowed to abort a fetus?

- If a woman demands divorce before consummating the marriage, does she need to return the Mahr?

- Are Muslim women allowed to live on their own, especially if they are financially independent? Or must they live with their parents?

- Is it permissible for a menstruating woman to enter the Masjid?

- Can a Muslim woman touch the Quran and read it during her period?

- Can a Muslim woman change her family name to her husband's surname?

- Is it permissible for a menstruating woman to enter the state of Ihram before the Meeqat without praying the two Rak’at of Ihram?

- Is it permissible for a menstruating woman to do Dhikr (remembrance of Allah SWT)?

- What does a woman do if she intended Hajj or Umrah and then started her menstrual cycle prior to reaching the Meeqat?

- During Hajj and Umrah, a woman who starts menstruating is afflicted with severe sadness and despair- what should we tell her?

- What does a menstruating woman do after she enters the state of Ihram and arrives to Makkah?

- What does a woman do if she entered the state of Ihram while she was pure, passed the Meeqat, performed Tawaf whilst pure then started menstruating after she finished her Tawaf and right before she started Sa’i?

- If a woman started menstruating before or after entering the state of Ihram and did not perform Tawaf for Umrah or Tawaf-ul-Ifada for Hajj and her Mahram/group with whom she traveled must leave to return to their country, what does she do?

- Is it permissible for a menstruating woman to enter the sacred Masjid in Madina and Makkah?

- Do the breastfed milk siblings have the same rights as blood siblings?

- If my sister and I wanted our kids, who are born a few months apart, to be siblings via breast milk, is it permissible? Are we able to do so with bottle feeding? If so, how many feeds does it need to be?

- What is the Islamic ruling on Muslim women following the Janazah (funeral procession) and going to the cemetery for burial?

- Is it permissible in Islam for a woman to voluntarily forgive her husband from the obligation of paying her mahr (dowry)? If so, under what conditions is such forgiveness valid?

- A sister and her fiancé have agreed that her mahr (dowry) will be a water well built in her name as Sadaqah Jariyah. She asks whether this can simply be written in the marriage contract on the day of the nikāh, or if additional steps are required to fulfill this agreement Islamically.

- What does it mean in Islam for a wife to obey her husband? Is she required to follow everything he says, without exception? What are the limits or boundaries of this obedience according to the Qur’an and Sunnah?

- Show all articles ( 30 ) Collapse Articles

-

Zakat

- What is Zakat?

- Are all IRAs restricted like the 401(k) with the same Zakat rulings?

- Can a previously married woman marry herself to a suitor without her Wali's (guardian) permission?

- Can you recommend an easy book on how to calculate Zakat?

- Can zakat be given to someone who has cancer and is receiving donations for treatment?

- Does one have to pay zakah on money or savings that he has already paid zakah on from the previous year?

- How to pay Zakat on asset investments?

- I have 2 houses and I live in both of them. Neither one is completely paid off, so how do I pay Zakat on them?

- I have a sister that is divorced and lives alone with her daughter, can I give my zakat al mal to her? As in, would it count as zakat on my behalf or would it be sadaqa?

- I never paid Zakat in my life and now I have learned it is a pillar of Islam, am I responsible for the past years? If so, I don’t know how to calculate that.

- Is it permissible to pay Zakat ul Fitr in cash?

- What are the steps that a virgin or previously married woman can take if a Wali (guardian) is abusing his authority and refuses to marry his daughter to a suitor?

- What is Nisab and its gold value?

- What is the argument for paying Zakat on restricted accounts?

- What is the Islamic ruling on any missed years of not paying Zakat? How do I rectify this?

- When does Zakat become due?

- When is Zakat due date?

- How do I figure out a Zakat amount to pay? When do I pay it? And who do I pay it to?

- If a person pays the zakah amount more than the amount that is required, can this person apply the extra paid amount for the upcoming year's Zakat due?

- Is paying out Zakat an obligation for the elderly with severe dementia?

- Is Zakat owed on retirement accounts, such as a 401K?

- What if one owes Zakat on a retirement account that one can’t pay?

- Can I pay my Zakat to my married sister?

- Is zakat obligatory upon the gold jewelry that a Muslim woman wears daily for adornment, and not for trade or saving?

- Show all articles ( 9 ) Collapse Articles

-

Visit the Mosque

-

New Muslims

-

Islamic Terminology

-

Ruqya

-

Islamic Names for Babies

-

Ramadan

Is it permissible to invest in Cryptocurrencies, specifically Bitcoin?

Below, please find the summary of the Islamic Economic Forum’s Declaration on Bitcoin:

Islamic Economic Forum (IEF) is a specialized group on WhatsApp founded by Sheikh Muhammed Khalid Hasani from Pakistan. The group includes Shariah Scholars, experts, practitioners, economists, academics, researchers, consultants, auditors, and regulators. The different academic institutions and regulatory bodies of the Islamic financial industry such as AAOIFI, CIBAFI, IFSB, INCEIF, ISRA, and the central Shariah Boards of various countries are represented in this forum.

Summary of the declaration:

The scholars have two different opinions. The first is permissibility, while the second is prohibition. The basis of both views is detailed in the following paragraphs, in addition to the consequences of each view

on financial transactions in practice.

First view: Permissibility

Scholars who are of this view consider that the criteria of mal, money, and

thamaniyyah (monetary usage) is ascertained in Bitcoin, they build their view

on the following:

1. Adhering to the legal maxim that says: “original rule is permissibility in financial transactions .”

2. Bitcoin is considered mal mutaqawwum (valuable property or asset recognized by the Shariah) that has legal value by virtue of the fact that in practice, it is exchanged for other currencies, goods, and services.

3. Bitcoin plays the functions of money or currencies in general, although not issued by a government authority. Besides, there is no economic or Shariah limit for currency to prevent that.

Discussion of the objections of this first view:

One of the objections to the first view is that Bitcoin is exposed to wild fluctuations, a large number of speculations, and illegal uses, however, this objection is discussed and defeated as the following :

– The volatility in the prices of Bitcoin, and then the relative instability in its value, affects the efficiency, as is the case of many contemporary currencies and equity, but does not affect its Thamaniyya (monetary value).

– The illegal uses of Bitcoin are contingent and do not affect the general Shariah rule, as many contemporary currencies are vulnerable, they are at risk of fraud as well. On the other hand, these illegal uses are reversible according to the studies referred to in this declaration.

– The ignorance of the issuer, as well as the absence of regulators and government control authority has no impact on the general Shariah rule; because all the rules of Bitcoin are publicly stated, and well-known to all players and customers through the applications of Bitcoin–Blockchain. The progress of the work in this field does not create salient features to form a firm Shariah rule in this regard. On the other side, the trust from a government backing in a currency is replaced here with blockchain technology which establishes trust in itself.

Therefore, according to the first view:

– It is permissible to be engaged in verifying and mining for the purpose of obtaining the units of Bitcoin, whether through possessing hardware and software directly or renting through the purchase of cards that authorize the use of a third party’s hardware. However, the Shariah rules of investment in mining through an E-wallet or authorizing the third party should be studied in each case on its own merits.

– It is permissible to exchange Bitcoin for other currencies, as well as accept them as a counter value in commodity transactions, furthermore it could be exchanged for other cryptocurrencies that are considered permissible.

– Exchanging Bitcoin with other currencies or with gold and silver is all regulated by the Shariah exchange rules (bai al sarf). It is worth mentioning that each cryptocurrency is considered a separate type of currency as is the case in a fiat currency. In addition, the accumulated Bitcoins are subject to the rules of zakat on gold and silver.

Second view: Bitcoin is Prohibited

This view is based on the following:

1. The ignorance of the issuer.

2. The ignorance of the future of Bitcoin.

3. The absence of the issuing authority or the guarantor of issuing.

4. The absence of government regulation and supervision.

5. A large number of speculations and relative instability of its value.

6. The large number of illegal uses.

7. According to the aforementioned elements, Bitcoin is not mal mutaqawwum

with legal value.

In fact, all these bases, which are mentioned in the discussions of the features

that affect Shariah rule, could be classified into four categories :

-The first category is the gharar (uncertainty), Jahala (ignorance) and qimar (gambling), and this category covers the first four points.

-The second category is that Bitcoin could be of “means to evil”, and this refers to points 5 and 6.

-The third category is non-consideration of Bitcoin as mal mutaqawwum.

-The fourth category is related to the prohibition of Bitcoin, according to some scholars, as a precaution, since it involves some doubtful elements that violate the permissible transactions according to the supporters of this view.

Concluding Remarks:

– This declaration is merely specific to Bitcoin, despite the similarities between cryptocurrencies (such as Bitcoin, Ripple, and Ethereum). Some differences may affect the Shariah rule of each case, and hence such differences shall be carefully examined.